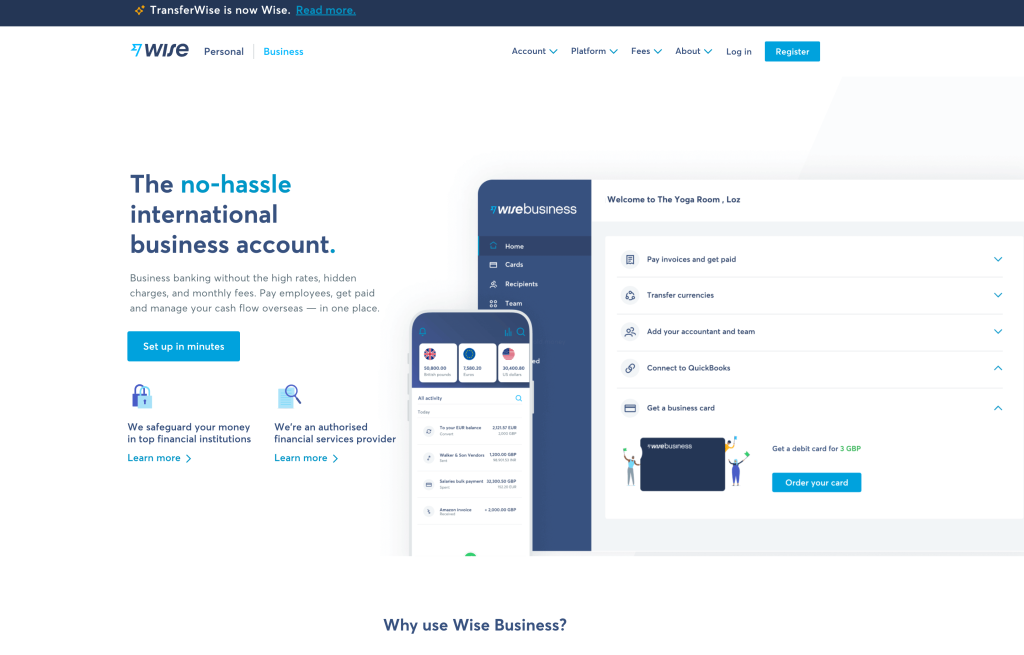

Wise is an overseas money transfer platform. The company – which until 2021 was called TransferWise – functions as an online foreign exchange broker, also offering a digital multicurrency account and an international card to customers. Wise differs from other options for moving money abroad by presenting lower transaction fees. Below, Techidence brings you a complete guide about Wise. See in detail how the service works and if the online exchange broker is reliable.

What is Wise and how does it work?

Wise is a free online foreign exchange broker that provides money transfers to foreign accounts and financial transactions abroad. The platform also offers its clients a multi-currency digital account and an international card.

Wise is a fast, secure, and cheaper option than other banks to make financial transactions. The institution differentiates itself by not embedding hidden values and by using the commercial exchange rate, which makes the process more cost-effective than other brokers.

The money transfer service works in 77 countries and provides support for 55 different types of currencies. In addition to the web version, Wise also has an application for Android and iPhone (iOS) cell phones.

Wise services and fees

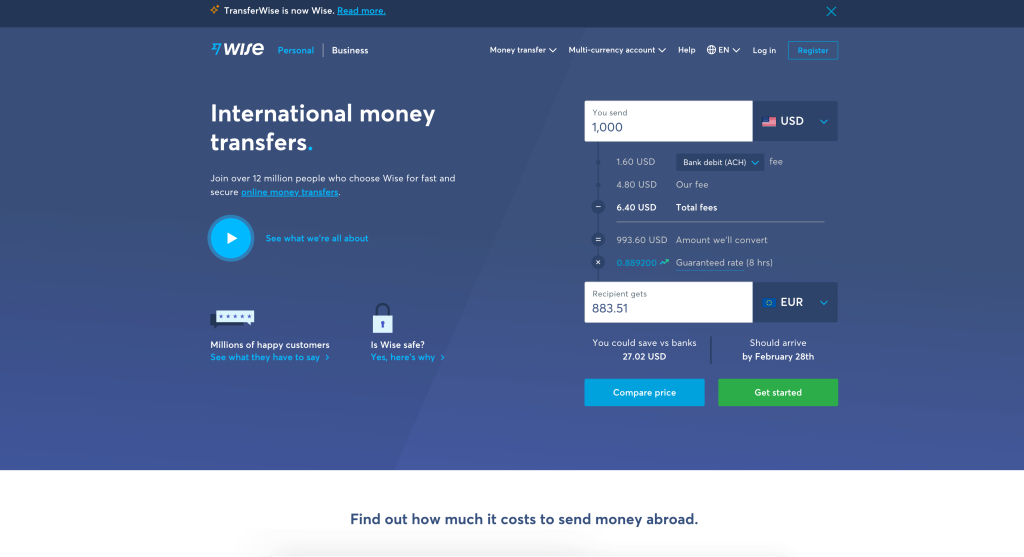

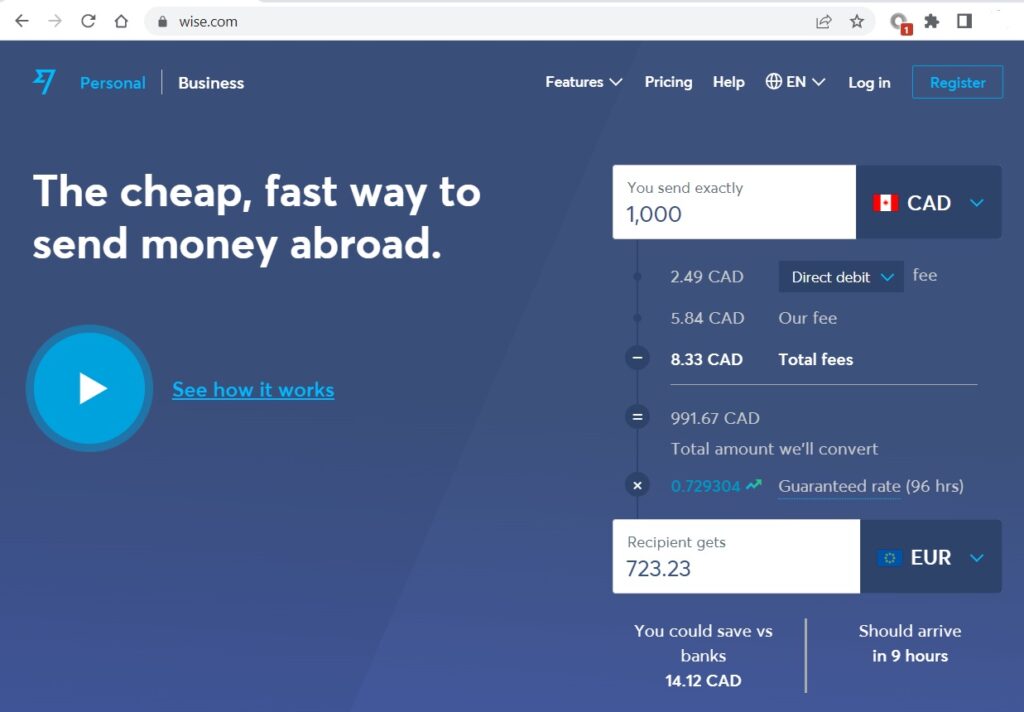

The final price of a money transfer at Wise will depend on the amount sent, the exchange rate, and the payment method. In general, the calculation includes a fixed fee, which varies according to the type of payment, plus tax. The tax rate differs when sending to your account, and when sending to someone else’s account. You can simulate the total amount of the transfer before completing the transaction.

The issuing of the Wise card, on the other hand, is free of charge – if you need to replace it, however, a fee will be charged. The digital card does not charge a monthly or annual fee and, with it, it is possible to make online and physical purchases in stores abroad. If the client already has, in his or her Wise multicurrency account, a balance available in the currency used in the transaction, it will be free of charge. Otherwise, the amount in the Wise account will be automatically converted. In this case, the exchange rate is applied.

How does the Wise multicurrency account work?

The Wise account is used to pay, save, receive, and send money in international financial transactions. With it, it is possible to store more than 50 currencies and perform the exchange conversion at any time. The process of sending money in the same currency from one Wise account to another is free.

To transfer amounts to a non-Wise account, there is a fixed fee built-in, which varies according to the currency of the country. Note that in case of transfer to another currency, even if the destination account is Wise, the exchange rate is also applied.

The Wise account is not considered a bank account, but an e-money account. This means that it is not possible to apply for loans or earn income, for example. The platform is licensed as a financial institution.

How to transfer money with Wise?

To transfer money with Wise you must first create an account on the platform. The procedure can be done by accessing “wise.com/register/#/email” (without quotes) or by the Wise application. In both cases, you must enter your e-mail address and create a password. If you prefer, you can also register using your Google or Facebook account.

Then you must inform the amount you want to send and select the type of transfer that is being made. Wise will ask you for some personal data, such as your address. You must also add the details of the person who will receive the money – if the recipient is a Wise customer, just enter the e-mail, otherwise add the bank details. If you don’t know, just include the e-mail so that the institution can contact the person requesting the information.

Then simply confirm the transaction details and select the type of transfer. Wise points out that payment by bank transfer is more economical. In this case, you must operate directly from your bank branch, Internet Banking, or the bank’s app. At this stage, Wise will inform you of the fees and the deadline for the money to reach the recipient’s account. After receiving the money, the broker will send a confirmation e-mail. When the amount is on its way, you and the person who will receive the amount will be notified about the transaction.

Another option is to open a Wise multicurrency account, which makes the process easier. Once you have added money to it, you can use the balance available there to make transfers. The procedure is simple: you open Wise, choose the balance of the currency you want to send money to, and select the “Send” option. Once you have done this, simply enter the amount you want to send and choose the beneficiary account.

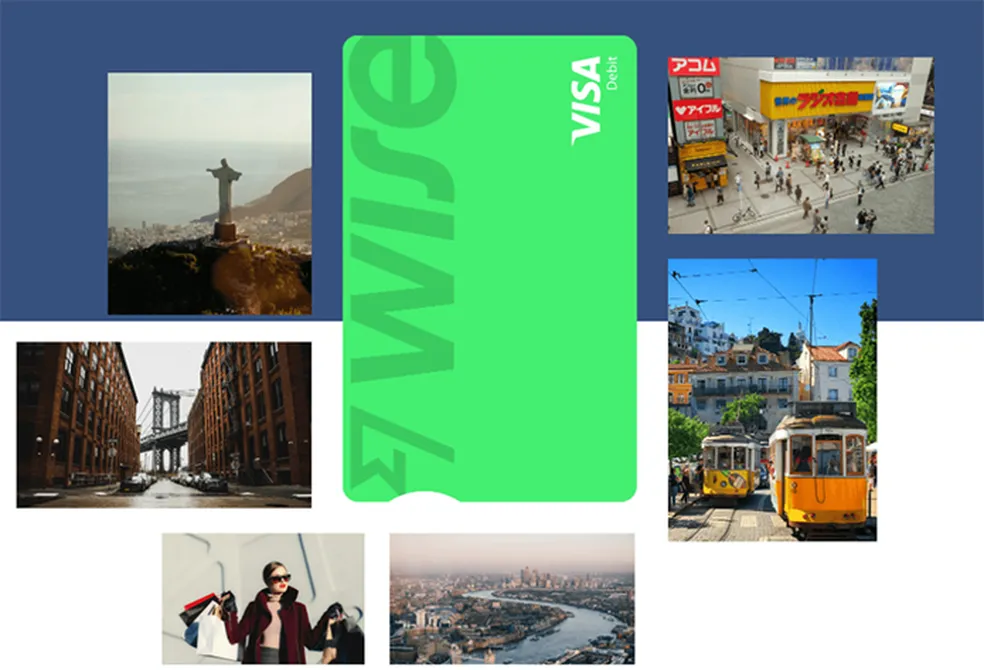

How does the Wise card work?

The Wise card is an international debit card that works in over 200 countries and supports more than 55 different currencies. In addition to making purchases, it allows you to make withdrawals of up to $4,000 per month. According to Wise, the card’s fees can be up to seven times cheaper than those of a conventional international card. The item is issued free of charge and does not charge an annuity or maintenance fee. To make purchases with the card, it is necessary to have an available balance in the Wise multi-currency account.

The unique thing about the Wise card is that unlike international multi-currency cards issued by other brokers, it does not require the customer to have a balance in the transaction currency to complete the transaction. If you spend money in a currency that you already have in your Wise account, the amount will be deducted for free. But if you are buying in euros (€), and only have money in real ($), for example, the amount will be converted automatically (plus the exchange rate). So you don’t have to worry about converting your money before you travel.

To apply for a multicurrency card, simply create an account on Wise through the website or application. Then go to the “Cards” area and enter personal information such as name and address. Then go through the verification process by sending a photo of your ID and creating a four-digit password for the card. At the end of the application, Wise will send an e-mail with the estimated delivery time to the added address. The numbering, however, is informed on the spot, and you can use the card virtually even before the plastic arrives at your home.

Is Wise secure?

Wise is reliable, as it is authorized to perform its function as a financial institution. In addition, the company has been operating since 2011 in the financial market and already adds more than nine million customers in 71 countries. For reference purposes, Wise’s score on the review portals is great. The company’s solution index on the page is 83.6%, and 76.7% of people would do business with the digital brokerage again.

Is Wise worth it?

Yes, with a simple and intuitive interface and cheaper rates than those practiced by the exchange market, Wise simplifies and cheapens the receiving or making of international payments. Moreover, the platform is a good alternative for those who need to move money online without bureaucracy. In the service, customers do not depend on the intermediation of the exchange houses’ brokers to buy international currencies and can do everything in a few clicks. Another positive point is security: since all movements are made through the computer or cell phone, it is not necessary to leave with cash from a brokerage house or bank.

This post may contain affiliate links, which means that I may receive a commission if you make a purchase using these links. As an Amazon Associate, I earn from qualifying purchases.