We bring you a list of 19 apps to control expenses and your home economy, so you can always keep track of your expenses. Sometimes, we notice that we are spending money on small expenses and we do not realize it, so these applications will help you to be more aware of it.

With these tools, you will be able to keep track of the expenses and income you make, have them well categorized, and get all kinds of reports and comparisons to see how your money is moving. You will also see tools to manage your online subscriptions or to save a little money each month.

And as we always say in Techidence, if you know of any other tools that might be useful to the readers of this list, we invite you to share them with us in the comments section. This way, all our readers will be able to benefit from the knowledge of our Techidents.

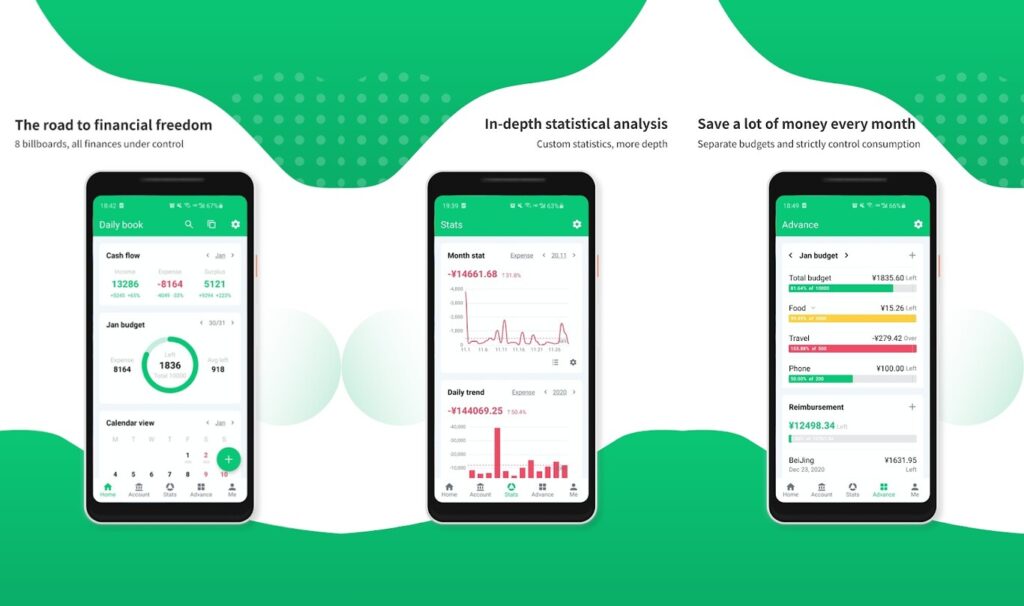

1Money

Let’s start with a powerful app that has the disadvantage of being only available for Android. But if you are in the Android ecosystem, you should know that you can use it on several devices at once. In this list, you will see apps that allow you to link your bank accounts, but here you will have to add income or expenses manually, but always in a very simple and intuitive way.

Once you have added your transactions, the application will generate reports and categorize the expenses so that you know where your money is going. You’ll have plenty of informative graphs, the ability to create yourself a budget and move towards it with your savings and be able to use multiple currencies.

- Links: Official website and Google Play

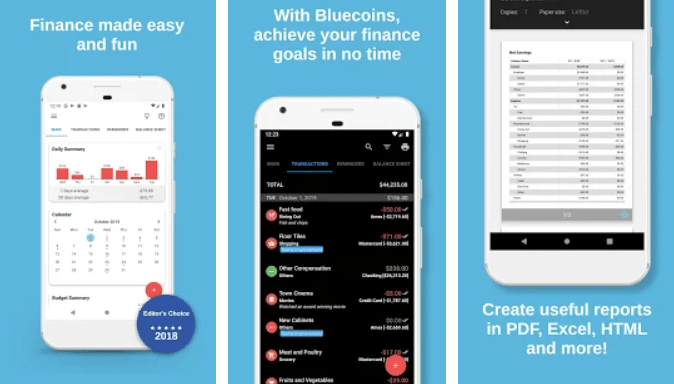

Bluecoins

Bluecoins is one of the most interesting alternatives that have been launched in recent times in this app category. It is a finance manager like many of those you will see in this list, but it stands out for its well-kept interface and a good list of options and types of information that you will be offered.

The app offers an overwhelming amount of information, with a daily summary of your movements with the associated accounts or cards, a monthly calendar, summaries of budgets and earnings with graphs, as well as your net worth, or your cash flow. It also synchronizes the information via the cloud with your other devices, so you can use it wherever you want.

- Links: Official website and Google Play

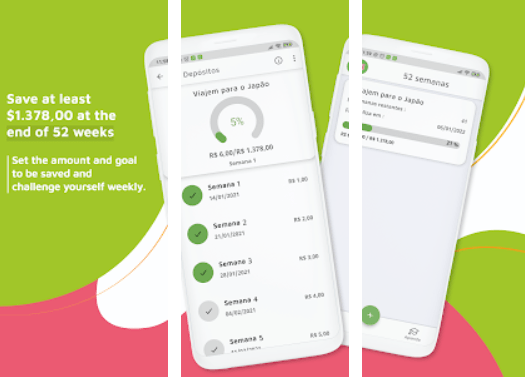

52 Weeks Challenge

This is a slightly different app than the previous ones, but we include it because, in the end, it can also be a tool to control your expenses. However, what it does is set you a challenge to save little by little over several weeks, gradually increasing the amount of money you contribute.

The way it works is simple. You start by contributing a small weekly amount to your savings, but week by week it will gradually grow. In this way, the idea is that by the end of 52 weeks you will have saved $1,378 with this method. This is a progressive way of saving so that you don’t start out having to save large amounts per week and you can gradually adapt to the amounts you set aside.

- Links: App Store and Google Play

Fintonic

Fintonic is possibly one of the most important and well-known personal finance management applications out there. So much so that companies like Amazon have sought partnerships with it. But the operation of this Spanish app is quite simple and focuses on being a kind of aggregator of personal financial information, where you can keep an exhaustive control of the expenses you make each month.

All you have to do is add your bank accounts, mortgages, or other products so that the app unifies the information on your expenses and income, and organizes them into categories. It also offers recommendations, you can customize goals, and it takes care of leaving you well-marked expenses such as commissions or duplicate receipts.

Links: Official website, App Store and Google Play

Goodbudget

This is an application focused on creating budgets for your expenses, being able to design envelopes for restaurant expenses, leisure, or whatever you want. In addition to this, like most of the applications on the list, the app will also allow you to control all your expenses and your income to keep a good accounting.

With all the information about your finances, it will show you graphs, and expenses will be well categorized. Also, it has widgets based on your location for your common expenses, synchronizes on all your devices, and allows you to export transactions in CSV format on its web page, so you can work with it separately.

- Links: Official website, App Store and Google Play

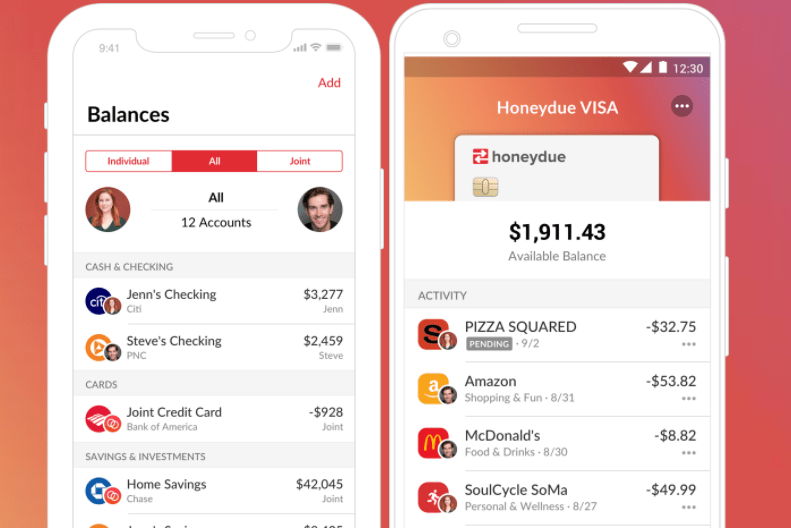

Honeydue

It is an application based on a very interesting idea: to be able to control your finances as a couple. You can add your account and your partner’s, and both of you can keep track of how much you spend and where the money goes. It will also allow you to send money to your partner, and set monthly limits for your family expenses.

The app lets you create your custom categories for expenses, receive reminders for receipts, react with emojis to each other’s spending, or ask about a mystery purchase. It also has a feature for settling accounts with a partner, which divides shared expenses.

- Links: Official website, App Store and Google Play

Monefy

This is an application to centralize the information of your expenses, but unlike other alternatives, it does not ask you to directly link any account. Therefore, it is an app that can be of great interest to those who are most jealous of their privacy and those who do not want any company to have the data of their bank accounts.

In exchange, what this application proposes is that you enter your expenses manually and you can categorize them to know where your money goes and what you spend more. Also, the simple fact of entering these expenses manually makes you more aware of them. Plus, it’s an app that you can have synced across multiple devices.

- Links: Official website, App Store and Google Play

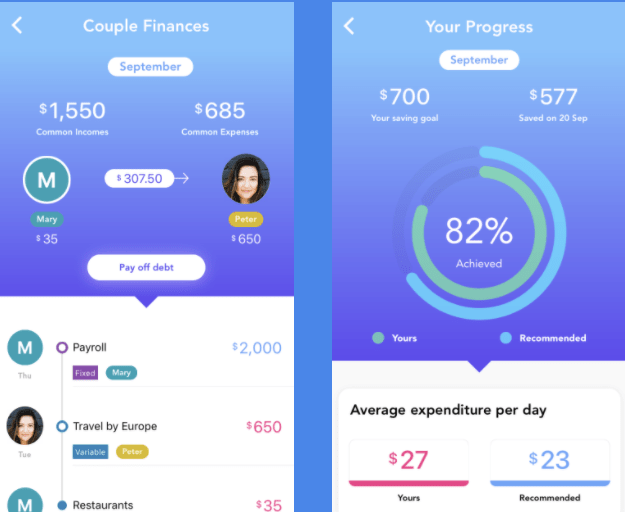

Moneyhero

An application that has been designed to try to help you achieve your savings goals. It does it simply since you only have to mark the expenses and fixed income of each month. Then, the app will tell you how much you can spend each day, and depending on what you specify, it will tell you how you are doing in your savings goal or if you are going to make it to the end of the month.

The application also offers monthly savings histories, graphs with your daily expenses, the possibility of managing finances as a couple or categorizing expenses to know where you spend the most money. You will also see the progress of your monthly savings, and it allows you to work in real-time from multiple devices with the data synchronized in the cloud. All this, with a simple and straightforward interface.

- Links: Official website, App Store and Google Play

Money Lover

Another very reputable application, so much so that it is included in Google Play suggestions. In addition to being able to link your bank accounts, the app also allows you to take a photo of tickets and receipts and add the expense to your account in the app. In this way, you can manually add the money you earn and spend, which will be organized into different categories.

The application is synchronized in the cloud to be used from all your devices or its web version, you can create shared folders, keep track of your loans, and ultimately get organized to try to save better controlling where you spend money. It also has a travel mode for when you leave the country, and the ability to make backups.

- Links: Official website, App Store and Google Play

Money Manager

This is another good application to manage your home economy. You will be able to see the income you receive and the expenses you make, with the option to take a photo and add geoposition to the different payments you make. Besides, like almost all apps of this type, you can add categories to sort payments.

The app also makes a forecast of expenses and has an interesting option such as password protecting the app. It also allows you to schedule transfers between your accounts, review your expenses in daily, weekly, monthly or yearly slots, and even download these expenses in an Excel file.

- Links: Official website, App Store and Google Play

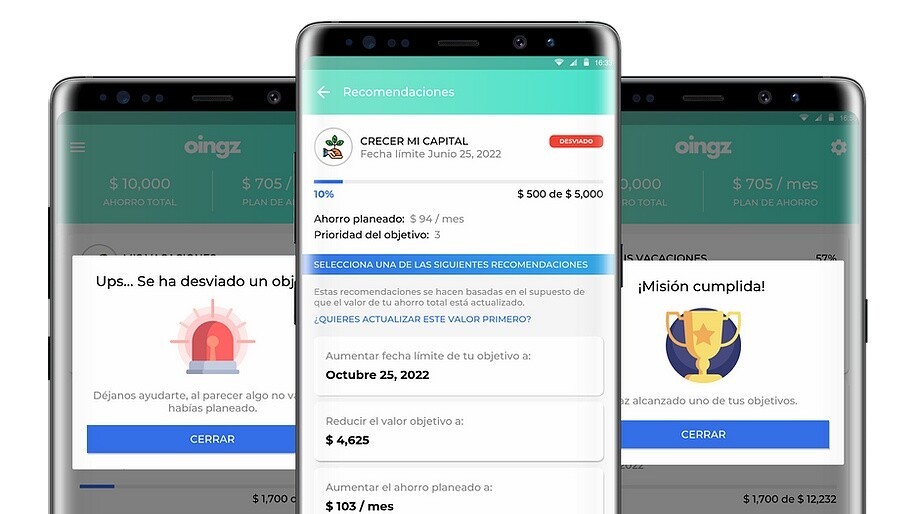

Oingz

Oingz is a fairly simple application and in this case exclusive for Android devices. What it aims to do is to allow you to organize your savings plans separately from the banks. Simply by helping you through the app without having to link anything.

The first thing is to choose the objective you want to save for, which can be anything from changing your cell phone or going on vacation to creating an emergency fund or having more money. Then, you will choose the monthly value you want to contribute, and the app’s algorithm will take care of organizing your money and to what goal you allocate it, automatically adjusting it to inflation to optimize savings.

- Links: Official website and Google Play

OpenBudget

It is an exclusive application for iOS, with versions for iPhone and iPad. It is an application where you must add transactions manually, but it simplifies the process so that you can do it in just a few seconds. Besides, you can add categories for expenses, and all data will always be synchronized between all your devices.

You can add recurring expenses to control your subscriptions to online services, and the app will offer you information based on reports and graphs to have a good perspective of where your money is going.

- Links: Official website and App Store

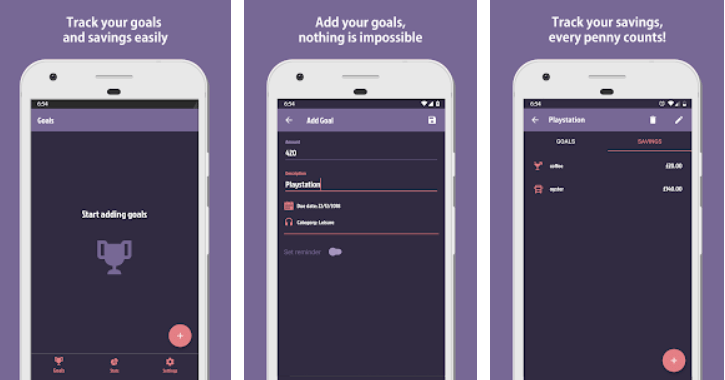

SavePal

SavePal is another Android-exclusive app that allows you to set savings goals. Once set, it will track your expenses and income, and tell you how often you’re saving, how much you’ve saved, and how much you have left to meet your goals.

It is a simple and uncomplicated application, specialized in helping you achieve your savings goals. For each goal, you’ll have the percentage of how much you’ve been saving, you can add reminders to motivate you, and you can view the history to see how your savings capacity is evolving.

- Link: Official website and Google Play

Spendee

It is another very reputable and award-winning application, although in recent updates there have been some complaints about some changes, but nothing that can not be refined again. It specializes mainly in offering you complete infographics about all your expenses, automatically categorizing them, and offering you graphs and even maps. You can also create shared portfolios with your friends.

The app syncs data so you can access it from other devices, including its web version. You can also create budgets, keep shared finances between partners or roommates, and work with multiple currencies.

- Links: Official website, App Store and Google Play

Sprouts

This is an independently developed app, which currently only has a version for Android phones. Its interface is not the best you will find, but it is functional and the app offers a lot of options and information with graphs and so on.

The application allows you to add your cards to keep track of your daily activities, which are categorized in the app and all the information you need is displayed. It also has widgets to show you the information on the screen without you having to enter the app.

- Link: Google Play

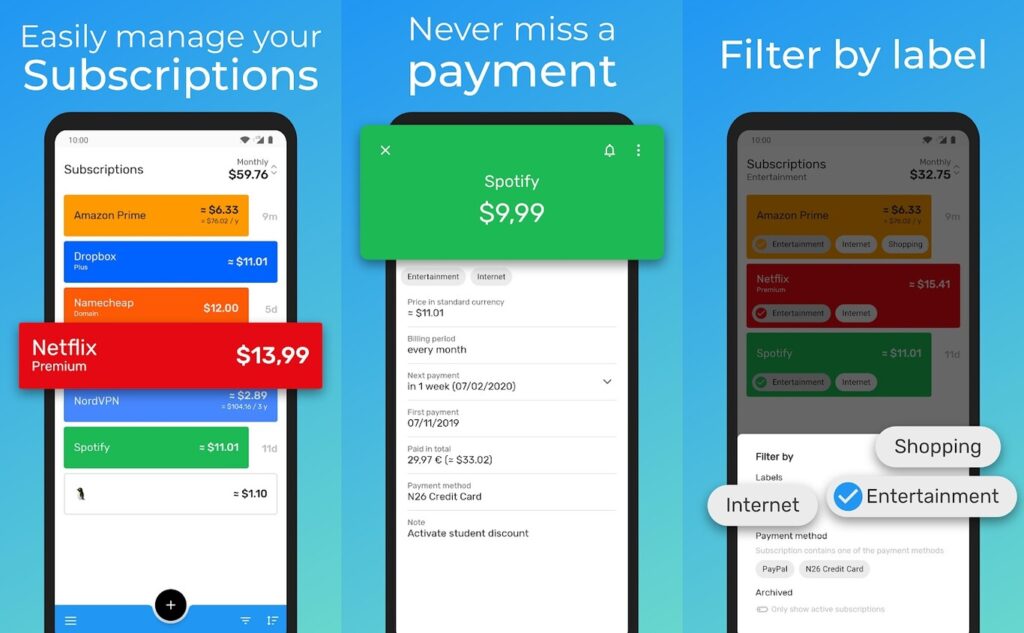

Subscriptions

Exclusive to Android, this is one of those applications that you didn’t know you needed, but you need. In these times when everything goes by subscriptions, this app lets you manage all the subscriptions you are registered to, whether it’s Netflix, Spotify, Amazon, Dropbox, or whatever.

And in the end, we end up paying for many services, and what this app does is show you how much you pay in total for everything you are subscribed to. To do this, you can add cards with each subscription, and in it, there is information about how much you pay, the account from which you do it, or when the next payment is due. This way, you can make informed decisions when you realize you’re paying too much and it’s time to cut back on subscriptions.

- Link: Official website and Google Play

TravelSpend

This is a perfect app to control your expenses when you go on a trip and has the benefit of not needing an Internet connection, so you will not need to rely on a tariff when traveling outside Europe. Also, it automatically converts the currencies of your expenses to your currency.

The idea of the app is that you can design a budget for a trip, and then track your expenses to see if you are sticking to the budget. It also allows you to split expenses, synchronize data when you do have Internet between all your devices, or export expenses to an Excel file.

- Links: Official website, App Store and Google Play

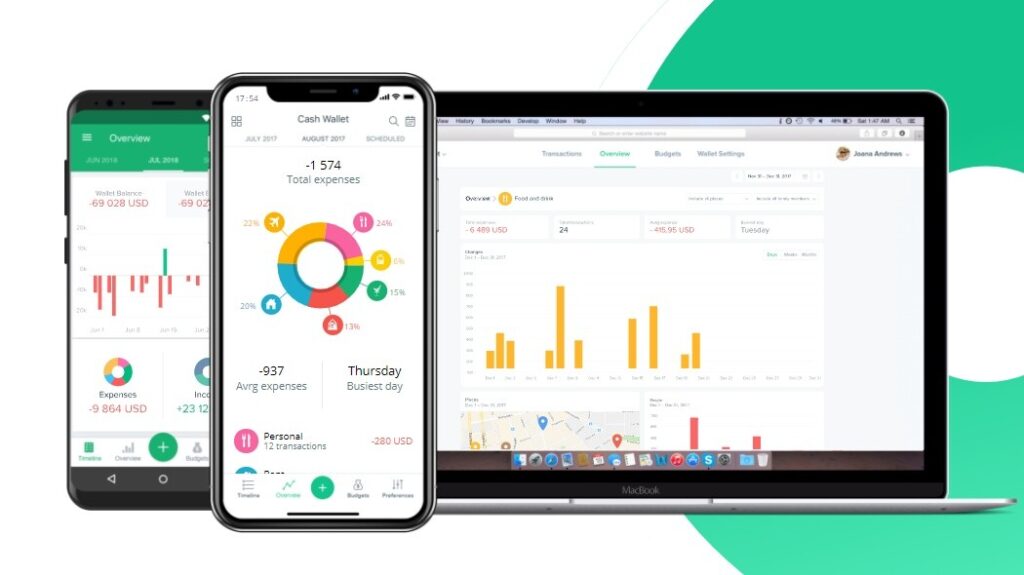

Wallet

Another monthly expense management application with a very neat interface, and comparative graphs where you can compare last month’s expenses with other previous periods. You can also add scheduled payments to know what you will have to pay in the coming days and take it into account when calculating your budgets.

You can also add your bills, categorize your expenses, and, very interestingly, record whether each of your expenses was worth it or not. So the next time you’re tempted to spend $10 on coffee at a trendy place you can know that last time you ended up thinking it wasn’t worth it.

- Links: Official website, App Store and Google Play

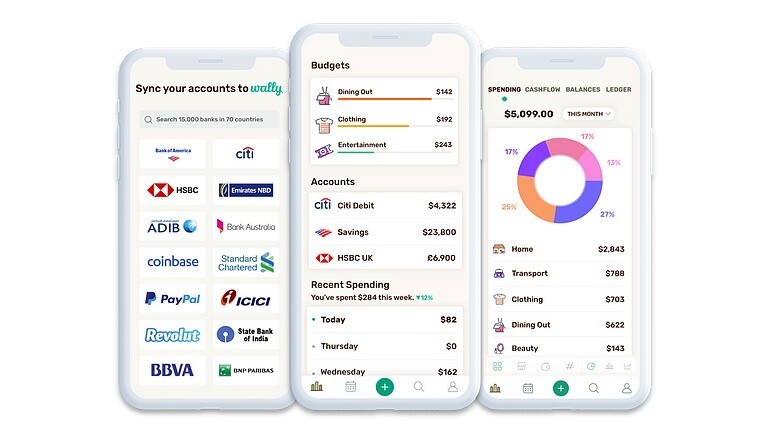

Wally

Another application that acts as a financial aggregator, where you can link your bank accounts or other services such as Coinbase or PayPal. The idea is that the web becomes a meeting point where you can see in an orderly manner the activities of all your associated services so that you have a more global view of all your movements.

Its interface may not be as sophisticated as Fintonic-style alternatives, but Wally seeks simplicity above all else. It also organizes your expenses and income into different categories and types, and you can create budgets and see how you are approaching them. Its main downside is that it’s not available on Android.

- Links: Official website and App Store

This post may contain affiliate links, which means that I may receive a commission if you make a purchase using these links. As an Amazon Associate, I earn from qualifying purchases.